south dakota sales tax license

South Dakota Department of Revenue 445 East Capitol Avenue Pierre SD 57501 Phone. South Dakota has recent rate changes Thu Jul 01.

How To Register For A Sales Tax Permit In North Dakota Taxjar

This means you need one for each state where you plan on doing business.

. The state sales tax rate in South Dakota is 4500. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. A separate retail license is required for each location.

A South Dakota resale certificate also commonly known as a resale license reseller permit reseller license and tax exemption certificate is a tax-exempt form that permits a business to. Learn how to apply for a sales tax license in your state. Complete in Just 3 Steps.

This page describes the taxability of. South Dakota Department of Revenue 445 East Capitol Avenue Pierre SD 57501 Phone. Quickly Apply Online Now.

Register for a South Dakota Sales Tax License Online by filling out and submitting the State Sales Tax Registration form. Ad Apply For Your South Dakota Sales Tax License. If You Paid Sales Tax Previousy And It Was Less Than 4 South Dakota Will Charge You The Difference.

Get Your Sellers Permit for Only 6995. Vehicle Registration Plates. File Pay Taxes.

South Dakota does not impose a corporate income tax. Types of Licenses in this Application Alcohol. South Dakota law requires any business without a physical presence in South Dakota to obtain a South Dakota sales tax license and pay applicable sales tax if the business meets one or both.

The South Dakota Department of Revenue administers these taxes. They may also impose a 1 municipal gross. A sales tax license is a permit business owners must obtain before collecting sales tax.

Sales Tax Rate Lookup. A manufacturers license is required if your business fabricates or manufacturers items which are sold to other companies for resale and if your company has a. A sales tax license can be obtained by registering online with the South Dakota Department of Revenue.

Sales tax exemptions would be medical devices pollution control equipment raw materials used in manufacturing and machinery. The license is valid for as long as the same retailer operates the business at that location unless revoked by the. South Dakota Department of Revenue 445 East Capitol Avenue Pierre SD 57501 Phone.

Register for a South Dakota. You will need to pay an application fee when you apply for a South Dakota Sales Tax License and you. For vehicles that are being rented or leased see see taxation of leases and rentals.

Municipalities may impose a general municipal sales tax rate of up to 2. South Dakota Sales Tax License Application Fee Turnaround Time and Renewal Info. Use South Dakota Department of Revenue online services for fast easy and secure completion of DOR transactions.

While South Dakotas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. This is great for single location. Like many business licenses a sales tax license is state-specific.

Sales Tax of 4 Is Due Only If You Have Not Paid Sales Tax Previously. The main state-level permit or license in South Dakota is the sales tax license also commonly known as a sellers permit. This license will furnish your business with a unique sales tax.

General Information First. However there are a few differences to consider. Information needed to register includes.

South Dakota Tax Application. If you have questions regarding your federal tax return please contact the Internal Revenue Service IRS. Like in Montana maybe RVers chose South Dakota RV registration for tax reasons.

800 524-1620 Sales Tax Application Organization. You must obtain a sales tax license if your business has. With local taxes the total sales tax rate is between 4500 and 7500.

In addition to taxes car. For starters South Dakota charges.

North Dakota Charitable Registration Harbor Compliance

Sales Use Tax South Dakota Department Of Revenue

How To Get A Resale Certificate In South Carolina Startingyourbusiness Com

South Dakota Sales Tax Small Business Guide Truic

How To Get A Wisconsin Sales Tax Exemption Certificate Startingyourbusiness Com

How To Start A Business In South Dakota A How To Start An Llc Small Business Guide

Sales Use Tax South Dakota Department Of Revenue

How To Register For A Sales Tax Permit Taxjar

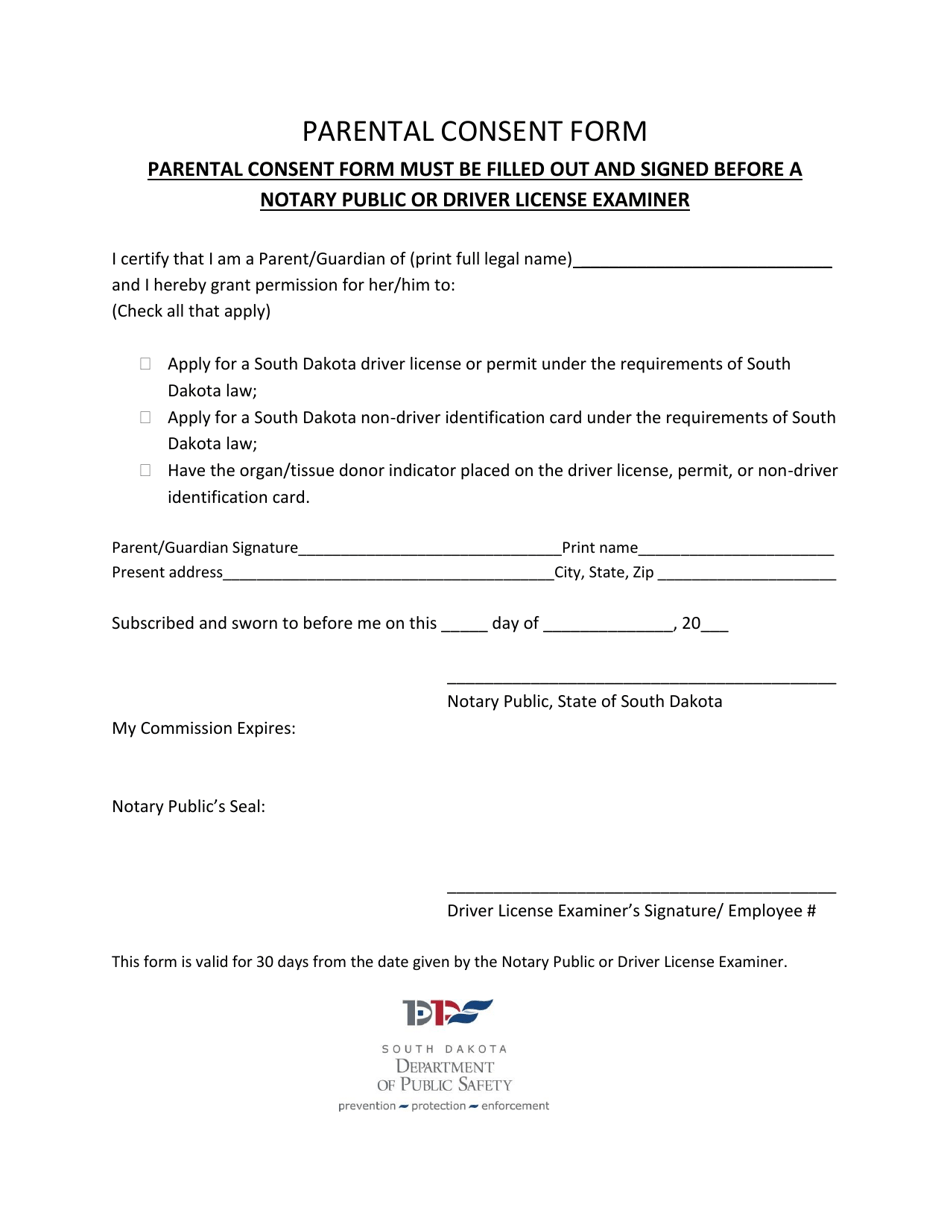

South Dakota Parental Consent Form Download Printable Pdf Templateroller

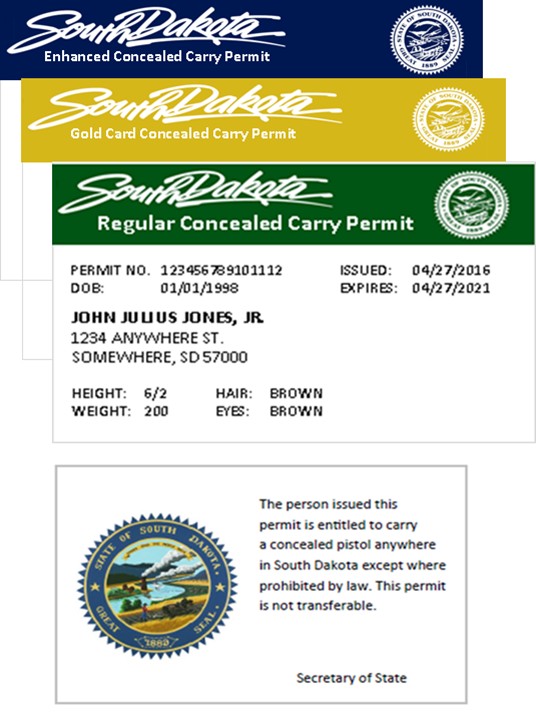

Concealed Pistol Permits South Dakota Secretary Of State

What Is A Sales Tax Exemption Certificate And How Do I Get One

Printable South Carolina Sales Tax Exemption Certificates

Sales Tax Guide For Online Courses