utah county sales tax calculator

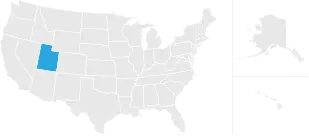

To find out the amount of all taxes and fees for your. This is the total of state and county sales tax rates.

Phototipthursdays Sales Tax Last Week I Had Some Questions About Taxes Do Photographers Need To Pay Sales Tax Photographer Needed Photo Utah County

The Utah County Utah sales tax is 675 consisting of 470 Utah state sales tax and 205 Utah County local sales taxesThe local sales tax consists of a 180 county sales tax and a.

. The amount you need to pay at the time of vehicle registration varies depending on vehicle type fuel type county and other factors. Or visit our Utah sales tax calculator to lookup local rates by zip code. Utah State Sales Tax.

Sr Special Sales Tax Rate. The Utah County Utah Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Utah County Utah in the USA using average Sales Tax Rates. So whilst the Sales Tax Rate in.

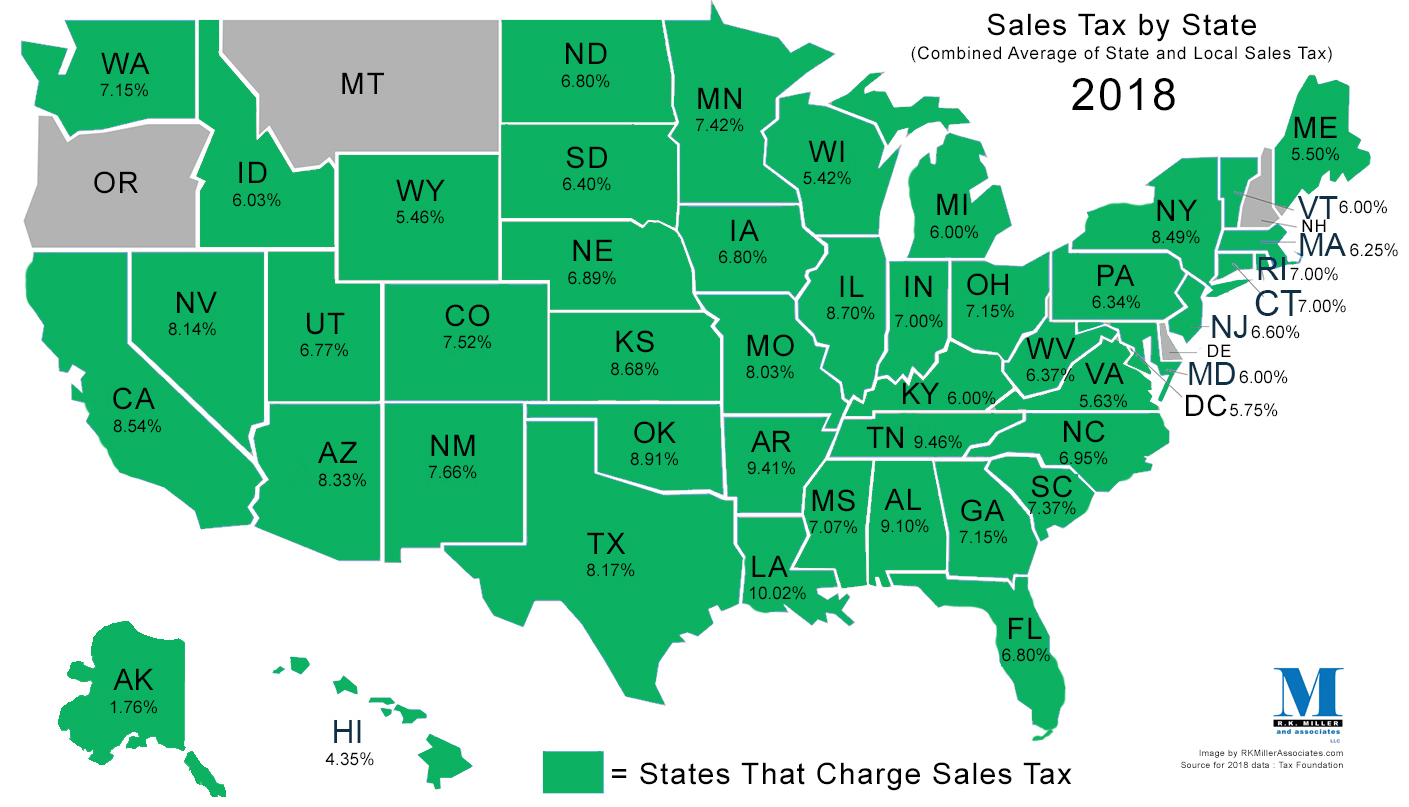

91 rows This page lists the various sales use tax rates effective throughout Utah. Local tax rates in Utah range from 0 to 4 making the sales tax range in Utah 47 to 87. According to Sales Tax States 61 of Utahs 255 cities or.

Utah County in Utah has a tax rate of 675 for 2022 this includes the Utah Sales Tax Rate of 595 and Local Sales Tax Rates in Utah County totaling 08. Counties and cities can charge an additional local sales tax of up to 24 for a maximum. Bars and taverns in Utah are also subject to restaurant tax on food sales and beverages including beer.

Learn More Get Started Today. Try our FREE income tax calculator. The Utah County Utah Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Utah County Utah in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Utah County Utah.

Explore Our Trusted Software Services to Find the Best Fit For Your Tax Needs. Up to date 2021 Utah sales tax rates. If you need access to a database of all Utah local sales tax.

Utah has state sales tax of 485 and allows local governments to collect a local option sales tax of up to 335. Ad Your Business Can Automate Sales Tax and File Returns for Free in 24 States with Avalara. What is the sales tax rate in Utah County.

Sales Tax Rate s c l sr. 2022 Iron County sales tax. S Utah State Sales Tax Rate 595 c County Sales Tax Rate.

The December 2020 total local sales tax rate was also 7150. The minimum combined 2022 sales tax rate for Utah County Utah is. Use our sales tax calculator or download a free Utah sales tax rate table by zip code.

TAX DAY NOW MAY 17th - There are -348 days left until taxes are due. Find your Utah combined state and local tax rate. The Utah state sales tax.

The current total local sales tax rate in Utah County UT is 7150. Our Certified Software Makes It Easier to Manage Multi-State Tax Compliance. L Local Sales Tax Rate.

Average Sales Tax With Local. With local taxes the total sales tax rate is between 6100 and 9050. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668.

Our free online Utah sales tax calculator calculates exact sales tax by state county city or ZIP code. Start filing your tax return now. Exact tax amount may vary for different items.

ICalculator US Excellent Free Online. You can find more tax rates and. Iron County Sales Tax.

Utah sales tax rates vary depending on which. Utah UT Sales Tax Rates by City all The state sales tax rate in Utah is 4850. Utah has recent rate.

For more information on sales use taxes see Pub 25 Sales and Use Tax General Information and. The restaurant tax applies to all food sales both prepared food and grocery food. Ad Accurate Easy Tax Solutions for Your Business.

Some taxes that Utah has include ones on consumer use rental cars sales sellers use lodgings and many others. 274 rows Utah Sales Tax. 2022 Utah Sales Tax By County Utah has 340 cities.

Sales Tax Expert Consultants Sales Tax Rates By State State And Local Rates

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Connecticut Sales Tax Calculator Reverse Sales Dremployee

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

States With Highest And Lowest Sales Tax Rates

Utah Income Tax Calculator Smartasset

How To Calculate Sales Tax Definition Formula Example

State And Local Sales Tax Rates 2013 Map Income Tax Property Tax

How To Calculate Sales Tax For Your Online Store

Virtually Every State Tax System Is Fundamentally Unfair Taking A Much Greater Share Of Income From Low And Middle Income Familie Higher Income State Tax Tax

Utah Sales Tax Small Business Guide Truic

How Do State And Local Sales Taxes Work Tax Policy Center

This Map Shows How Taxes Differ By State Gas Tax Healthcare Costs Better Healthcare

How To Charge Your Customers The Correct Sales Tax Rates